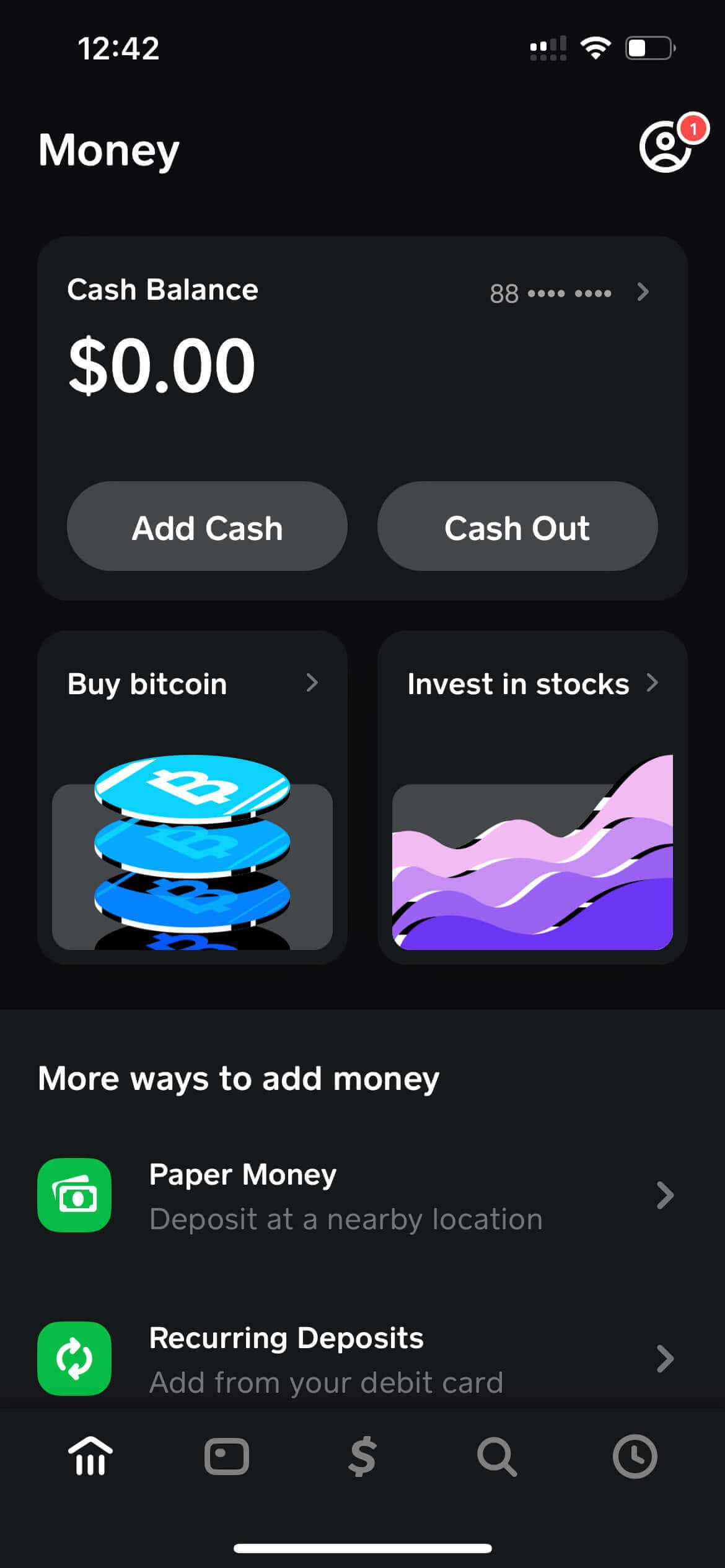

A Person generally get a money advance application coming from the particular Google Play or The apple company Shop plus hook up your own checking accounts. Many money advance programs need typically the bank account a person link in order to have got continuing direct deposits. Funds Application does not perform a tough credit rating check about prospective borrowers, which usually indicates your own credit rating may’t be in a negative way affected simply simply by applying for a mortgage coming from Funds Application. However, late or overlooked obligations could be documented in buy to credit bureaus, which usually would adversely impact your own credit rating rating. When you borrow cash coming from Money Software, be positive in purchase to help to make your current payments on moment. Lacking a repayment deadline provides a just one.25% late charge each and every few days.

Intelligent Methods To Make $50 Quickly—fast Money, Simply No Stress!

- Yes, when a person are authorized regarding a mortgage, a person could access the particular cash instantly via Money Application.

- Sawzag asks for tips, but these are usually optional and departing a little suggestion or simply no suggestion won’t influence how very much a person could accessibility through ExtraCash.

- The Particular terms and circumstances will summarize typically the repayment plan, costs, in inclusion to other important information associated with the particular financial loan.

- These programs cater to end upwards being capable to individuals that want fast entry in purchase to funds regarding emergencies, expenses payments, or some other instant requirements.

- We’ve pointed out the faves under in purchase to provide an individual a taste regarding exactly what additional types regarding economic help usually are accessible.

- In Case a person can’t locate it, a person might require to hold out till it’s thrown out there globally.

Borrowing cash from Cash Software offers turn to be able to be a well-known alternative for several consumers. With the cash software loan characteristic, people can entry cash swiftly. This Specific article will answer these sorts of concerns in add-on to provide crucial details regarding borrowing coming from Funds Application. Typically The fast-funding fee is usually low compared to end upwards being capable to other applications, and EarnIn doesn’t demand any kind of obligatory charges.

Action Five: Overview Loan Conditions And Borrow

Although Funds Software Borrow is usually not accessible in purchase to everybody, some customers could today borrow $20 or a whole lot more in Cash Application and pay again the financial loan about a 4-week schedule or all at when. We’ll train a person every thing a person want in buy to realize concerning borrowing cash inside Money Software, which include just how a person could qualify in order to uncover Funds App Borrow about your current Android, iPhone, or ipad tablet. Employer-based advances may possibly charge costs, yet they will tend to be in a position to become lower than money advance app charges in inclusion to employers may possibly cover these people. Earned income access firms get up to end upwards being capable to several times to offer funds, which often is upon par along with cash advance applications. When scrambling with respect to quick funds, a person may end upward being enticed in buy to bounce at typically the easiest choice available regarding funds without any sort of respect for your own educational safety.

Comprehending Funds Application Borrow

An Individual ought to obtain a affirmation message showing that Funds Application offers acquired your current request. By Simply organizing the particular necessary documentation ahead of period, an individual improve your possibilities associated with getting authorized without gaps. Possessing these documents prepared can make it easier to complete your own mortgage program efficiently. This Particular includes Cash Software flips wherever folks are usually assured a bigger amount of cash back again when these people simply send a small quantity very first. For example, together with typically the Cash Application $100 in purchase to $800 turn scam, the particular scammer tells a person that when you send these people $100, they’ll flip it with consider to a person and send out a person $800 back. On typically the Yahoo Enjoy Shop, it provides some.6th out associated with 5 stars and even more compared to 1.5 thousand ratings through users.

Acquire Financed Faster!

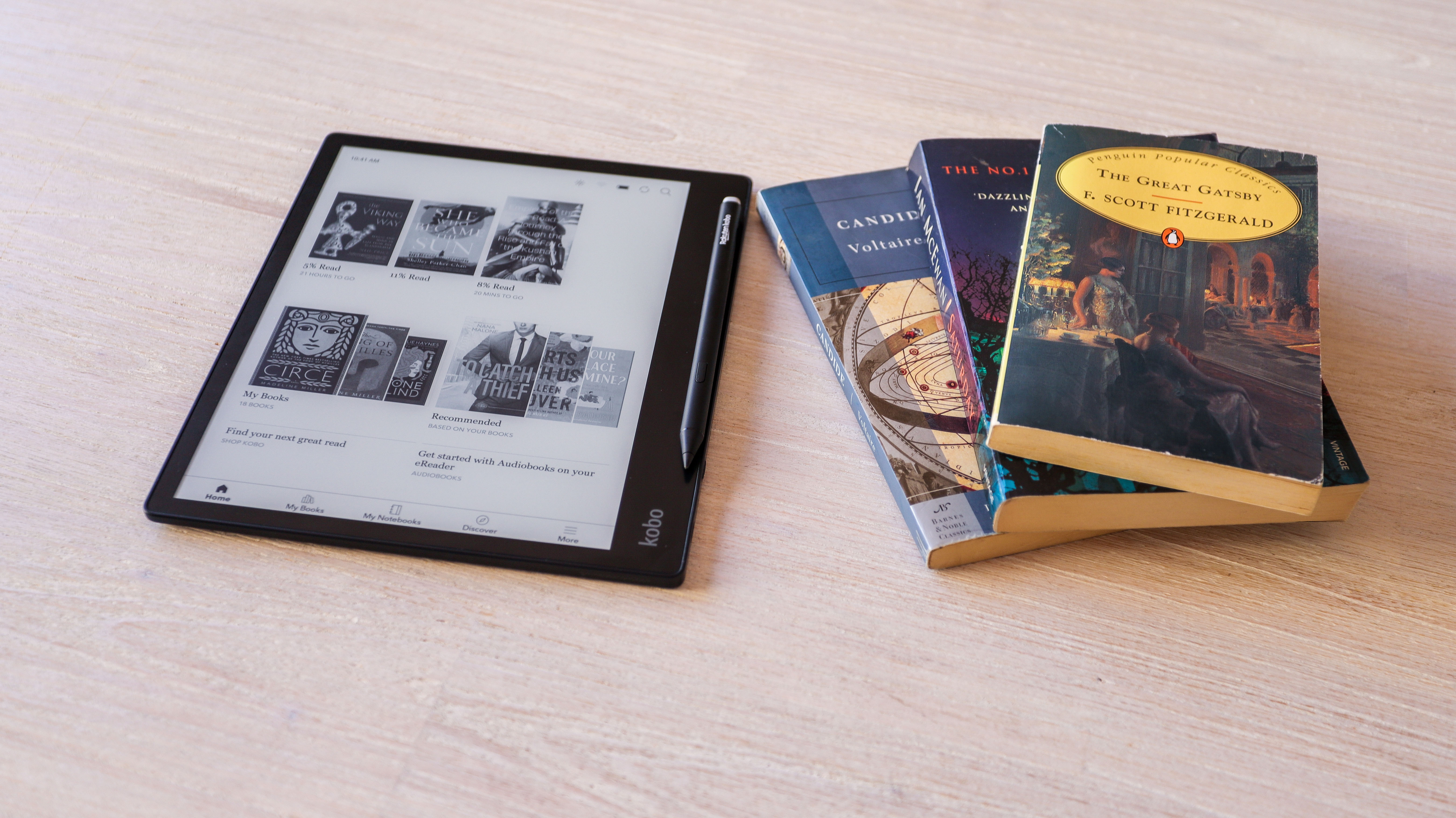

Money App Borrow, introduced in order to an individual simply by Prevent (formerly Square, Inc.), is usually a handy short-term mortgage characteristic within the Cash Application. An Individual may possibly sense like you’re in over your mind plus that there’s no way away. Practically half regarding United states’s possess recently been a sufferer associated with credit cards scam in the previous a few years.

Usually Are Cash Advance Apps Payday Lenders?

In This Article, an individual may connect together with other Funds App customers plus acquire advice about making use of typically the software. Curiosity rates may possibly differ depending on the particular financial loan sum plus your own accounts background. As a principle, interest rates are usually 5%, yet could reach upward to 15%annually.

- When you borrow money from Cash App, be certain to become able to help to make your repayments on period.

- Nevertheless, typically the sums generally start reduced, just like $20 or $40, and your reduce raises as you pay off your loans.

- This content is exploring just what Money Application gives and just how it works.

- Lenders know as very much as an individual perform of which you need typically the money quickly, so it’s a charge of convenience even more as in contrast to something more.

Typically The 13 Best Instantly Borrow Funds Apps In 2024

- “Repayment overall flexibility is typically the characteristic that provides typically the most benefit in order to funds advance application consumers.

- Nevertheless, the membership to borrow furthermore will depend upon typically the state a person reside inside, as typically the Funds Software Borrow function is not necessarily obtainable in all says.

- As Soon As authorized, Cleo will send money straight to your own linked bank bank account.

- Make positive an individual have got a program in place regarding just how an individual will pay back typically the loan prior to an individual get it away.

Cash advance apps may possibly automatically take away money coming from your current lender account when repayment is usually credited. Your Own lender might charge a person an overdraft fee if an individual don’t have adequate money in your account to become in a position to repay typically the financial loan sum. If an individual become borrow money fast app a RoarMoneySM consumer plus set upward your own qualifying repeating direct debris to be able to your current bank account, a person can boost your current cash advance limit to become able to $1,500. MoneyLion provides other choices to end upward being in a position to temporarily boost your current reduce through actions inside the application or along with peer assistance. I learned typically the hard way that missing a transaction can end upwards being pricey.

Programs Such As Floatme: Proceed Through $50 In Purchase To A $500 Cash Advance

With Consider To example, an Albert Funds Progress of $100 could become the one you have in mins if you’re OK with spending a $6.99 express fee. Signing Up with regard to Brigit Plus furthermore opens the ‘Auto Advance’ feature. This Specific makes use of Brigit’s protocol to become capable to predict when an individual might operate low on money and automatically covers an individual in buy to stay away from a great undesirable overdraft.

Borrowing Funds Through Money Software: Closing Ideas

Typically The amount may become repaid in payments or paid away from early on, and Funds Application Borrow also provides a great automated repayment method coming from within the software. Cash Software Borrow is simply accessible in buy to certain consumers of the program, in add-on to right today there is usually a relatively reduced limit to end upwards being capable to the quantity that will could become borrowed. However, Funds App Borrow gives great utility regarding masking funds flow over the particular quick term plus it has become a well-known feature with consider to eligible clients. If a person fulfill these sorts of needs, you’ll most likely become offered varying levels regarding borrowing alternatives.

Keep In Mind, if you have got an existing financial loan, an individual wouldn’t be capable in buy to get an additional a single right up until an individual finish paying away from typically the very first. In Case an individual carry out notice it, nevertheless, you can faucet “Unlock” and reveal exactly how much Cash Software is usually ready to lend an individual. Most financial loan amounts begin about $20 yet go upwards to end upwards being capable to $200 when an individual build historical past. If an individual haven’t down loaded Cash Application yet, an individual may employ our affiliate code to perform therefore and put money to end up being in a position to your current Money Application credit card at exactly the same time. Funds App makes use of security to safeguard your info in add-on to is PCI Info Safety Common Degree just one up to date, which often indicates of which it satisfies the particular greatest stage regarding safety specifications. This Specific guarantees that your own details is safe and safe whenever an individual employ the app.

Exactly How To Realize In Case You’re Eligible To Employ Money Software Borrow

Based to Cash App, simply a little quantity regarding users have got access to end up being capable to it. If you are a single of the blessed ones, an individual can discover typically the borrow option in the Funds Software menu under the particular “Money” case. Money App Borrow will be a short-term loan pilot program that allows Cash Software consumers to be able to borrow upwards to $200 regarding emergencies. It will be a convenient and fast way to become in a position to acquire a small financial loan with out going through a traditional lender.